Capital Credits

Patronage Capital

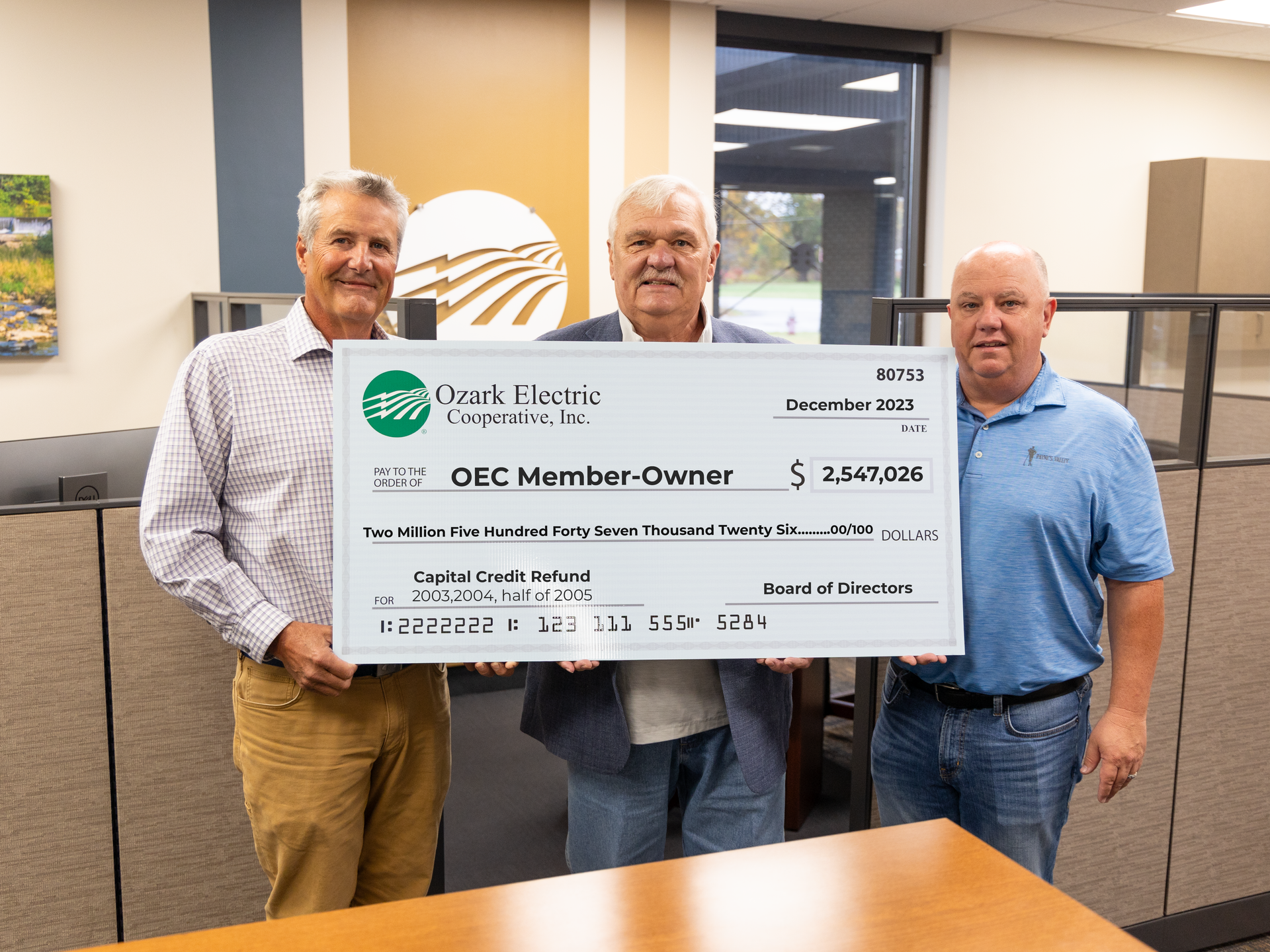

In 2023, your Ozark Electric Co-op Directors authorized the retirement of $2,547,026 in Capital Credits for 2003, 2004, and half of 2005 to Cooperative members who were ACTIVE members during these years. If those members are still members today, they will receive a credit on their December 2023 bill. Those who are no longer current but who were members in 2003, 2004, and 2005, will receive a check in the mail. Capital Credits are just one of several advantages of being a member of an electric cooperative. For more information, please read the FAQs below.

Capital Credits Frequently Asked Questions (FAQ)

-

What is a Cooperative?

A cooperative is a business that is owned and controlled by the people who use its services.

-

What are Capital Credits?

A cooperative does not earn profits in the sense that other businesses do. Instead, any margins, or revenues remaining after expenses have been paid, are allocated to the members in proportion to their usage of the co-op's services. Capital credits represent each member's share of the cooperative's margins and ownership of the co-op.

-

What do cooperatives do with Capital Credits?

Every business needs to maintain a suitable balance between debt and equity to ensure its financial health and stability. Capital credits are the most significant source of equity for most electric cooperatives. In addition to expenses the cooperative has capital expenditures (poles, conductor, transformes, equipment, etc.) that must be financed through either debt (borrowed funds) or equity (rates). Using equity (capital credits) to finance a portion of capital expenditures helps keep rates at a competitive level by reducing the ammount of funds that must be barrowed.

-

How does the cooperative determine who receives Capital Credits ?

Capital credits are allocated to each member of Ozark Electric Cooperative every year based on the participation in the cooperative. The allocations are based on the total dollar ammount of services purchased.

-

How does the cooperative notify members about Capital Credits allocations?

Ozark Electric Cooperative notifies its members of annual capital credit allocations through the "Electric Sparks/Rural Missouri" newsletter. Also, each member receives notification of prior years allocation ammount on their June/July billing statement.

-

How are retirements of capital credits determined?

Each year the board of directors determines whether the co-op's financial position permits the return, or retirement, of capital credits and, if so, what ammount of capital credits will be retired.

-

How are capital credits disbursed?

The board of directors decides the method for determining how capital credits are returned. In 2023, the board authorized retiring capital credits using the First-in, First-out, of FIFO, method. That means that the capital credits that have been invested in the cooperative for the longest period of time are returned to the members first. Retirements will be for the years of 2003, 2004, and half of 2005 and total $2,547,026. Members who were members between 2003 - 2005 and are still members at the time of disbursement will receive a credit on their December bill statement. Previous member who have made claims will receive checks in mid-December.

-

Do members receive interest on capital credits?

Cooperatives do not pay interest on capital credits because the money to pay that interest would have to be collected from members through higher rates.

-

What happens to a member's capital credit if the member dies?

Capital credits in the member's account belong to the member's estate. The heir of the estate should submit an Affidavit of Heirship (see link below) in order to claim the deceased member's capital credit retirement. Download Affidavit of Heirship Form Here

-

Why does the co-op not charge lower rates instead of retaining capital credits?

The board of directors has a fiscal responsibilty to maintain the financial integrity of the cooperative in a way that provides competitive rates and allows the return of capital credits to members. Having a sound equity management plan and a commitment to serving the members are key to achieving this.

-

Does the member have to report capital credits on tax returns?

Capital credits are a return of money paid for electricity in a previous year and are generally not taxable income for residential consumers. Commercial and industrial consumers should discuss any capital credit retirements with their tax advisers.

-

Office Location & Hours

Office Hours:

Monday - Friday

7:30-4:30

Closed 12-1

Mt. Vernon

417-466-2144

P.O. Box 420

10943 Hwy 39

Mt. Vernon, MO 65712

Nixa

417-725-5160

P.O. Box 1050

2007 James River Court (Hwy AA)

Nixa, MO 65714

Cape Fair

417-538-2273

P.O. Box 287

7928 State Hwy 76

Cape Fair, MO 65624